How to Make the most of the Benefits of a Secured Credit Card Singapore for Financial Growth

How to Make the most of the Benefits of a Secured Credit Card Singapore for Financial Growth

Blog Article

Introducing the Opportunity: Can People Discharged From Insolvency Acquire Credit History Cards?

Comprehending the Influence of Personal Bankruptcy

Upon declaring for personal bankruptcy, people are faced with the substantial consequences that permeate different elements of their financial lives. Insolvency can have an extensive influence on one's credit history, making it challenging to gain access to credit or finances in the future. This economic tarnish can stick around on credit report reports for several years, impacting the individual's capability to protect favorable rate of interest or financial opportunities. Furthermore, insolvency might result in the loss of possessions, as certain properties may require to be liquidated to pay off creditors. The psychological toll of insolvency must not be ignored, as individuals may experience sensations of embarassment, guilt, and anxiety as a result of their monetary scenario.

In addition, bankruptcy can limit employment possibility, as some companies conduct credit score checks as component of the hiring procedure. This can present an obstacle to individuals seeking brand-new job potential customers or profession developments. Overall, the effect of insolvency expands beyond financial restrictions, influencing numerous elements of an individual's life.

Elements Influencing Charge Card Authorization

Acquiring a credit rating card post-bankruptcy rests upon various key factors that significantly influence the approval process. One crucial variable is the candidate's credit score. Adhering to bankruptcy, individuals typically have a reduced credit history as a result of the unfavorable effect of the personal bankruptcy declaring. Debt card companies normally look for a credit history that shows the applicant's capacity to handle credit scores properly. An additional important consideration is the applicant's earnings. A steady revenue reassures charge card providers of the individual's ability to make prompt repayments. Additionally, the size of time because the bankruptcy discharge plays an essential function. The longer the period post-discharge, the a lot more beneficial the opportunities of authorization, as it indicates monetary stability and accountable credit scores behavior post-bankruptcy. Moreover, the sort of credit history card being gotten and the issuer's certain requirements can likewise influence approval. By meticulously taking into consideration these aspects and taking steps to restore credit history post-bankruptcy, people can enhance their leads of getting a credit score card and working in the direction of financial healing.

Steps to Reconstruct Credit After Bankruptcy

Rebuilding credit score after personal bankruptcy needs a calculated strategy concentrated on economic self-control and regular financial debt management. One efficient technique is to acquire a protected debt card, where you transfer a particular amount as security to establish a credit scores limitation. In addition, think about ending up being an authorized customer on a family members participant's credit history card or check out this site exploring credit-builder car loans to more improve your debt score.

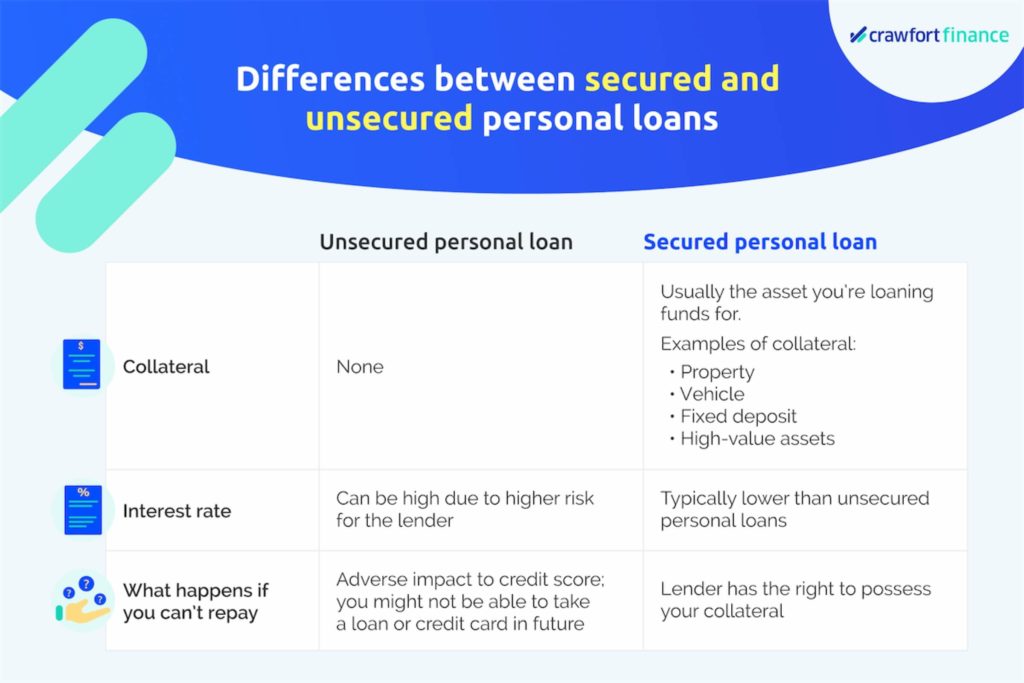

Secured Vs. Unsecured Credit Score Cards

Adhering to personal bankruptcy, people commonly consider the choice in between secured and unsecured credit cards as they intend to reconstruct their credit reliability and financial stability. Safe credit history cards call for a cash money down payment that offers as security, commonly equivalent to the credit limitation granted. Ultimately, the option in between protected and unsafe credit cards should align with the person's economic goals and capability to handle credit scores properly.

Resources for People Looking For Credit Restoring

For people aiming to improve their creditworthiness post-bankruptcy, exploring readily available resources is important to efficiently navigating the credit rating restoring procedure. secured credit card singapore. One valuable resource for people seeking credit history restoring is credit history counseling agencies. These companies use economic education and learning, budgeting aid, and customized credit renovation plans. By collaborating with a credit therapist, individuals can obtain understandings right into their debt reports, learn methods to improve their credit report, and receive assistance on handling their funds successfully.

An additional handy source is credit history tracking services. These solutions allow people to keep a close eye on their credit reports, track any type of errors or modifications, and identify prospective indicators of identity burglary. By checking their credit rating frequently, individuals can proactively deal with any kind of problems that more tips here may arise and make certain that their debt info is up to day and precise.

Moreover, online devices and sources such as credit rating simulators, budgeting applications, and economic literacy sites can provide individuals with beneficial info and tools to aid them in their credit history restoring trip. secured credit card singapore. By leveraging these sources successfully, people released from bankruptcy can take significant actions towards enhancing their credit scores health and wellness and safeguarding a better monetary future

Verdict

In verdict, individuals discharged from personal bankruptcy may have the possibility to acquire bank card by taking steps to rebuild their credit score. Factors such as credit score debt-to-income, history, and income ratio play a significant article source duty in charge card approval. By understanding the effect of bankruptcy, picking between secured and unsafe debt cards, and utilizing resources for credit restoring, people can enhance their creditworthiness and possibly acquire accessibility to charge card.

By functioning with a debt counselor, people can gain insights into their credit scores reports, discover strategies to improve their credit history scores, and obtain advice on managing their finances effectively. - secured credit card singapore

Report this page